Clarendon County Sc Property Tax Rate . internet payments will reflect the following business day. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Payments mailed or delivered to the auditor and treasurer’s office will. Compare your rate to the south carolina and. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property.

from www.land.com

Payments mailed or delivered to the auditor and treasurer’s office will. Compare your rate to the south carolina and. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. internet payments will reflect the following business day. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value.

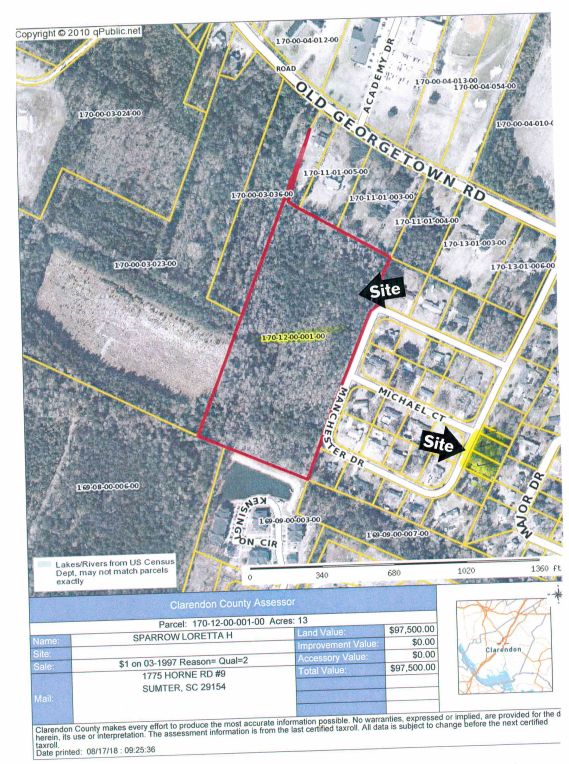

13 acres in Clarendon County, South Carolina

Clarendon County Sc Property Tax Rate the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Payments mailed or delivered to the auditor and treasurer’s office will. Compare your rate to the south carolina and. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. internet payments will reflect the following business day.

From www.youtube.com

Understanding SC Property Tax Rates 4 vs. 6 Explained YouTube Clarendon County Sc Property Tax Rate our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. calculate how much you'll pay in property taxes on your home, given your location and. Clarendon County Sc Property Tax Rate.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Clarendon County Sc Property Tax Rate the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. internet payments will reflect the following business day. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. calculate how. Clarendon County Sc Property Tax Rate.

From rfa.sc.gov

Property Tax Reports South Carolina Revenue and Fiscal Affairs Office Clarendon County Sc Property Tax Rate our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the south carolina and. Payments mailed or delivered to the auditor and treasurer’s. Clarendon County Sc Property Tax Rate.

From www.youtube.com

The Different South Carolina Property Tax Ratios 4 vs 6 YouTube Clarendon County Sc Property Tax Rate calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Payments mailed or delivered to the auditor and treasurer’s office will. internet payments will reflect the following business day. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. . Clarendon County Sc Property Tax Rate.

From learningschoolhappybrafd.z4.web.core.windows.net

Nc County Tax Rates 2024 Clarendon County Sc Property Tax Rate our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. calculate how much you'll pay in property taxes on your home,. Clarendon County Sc Property Tax Rate.

From www.mapsales.com

Clarendon County, SC Zip Code Wall Map Basic Style by MarketMAPS MapSales Clarendon County Sc Property Tax Rate the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. Compare your rate to the south carolina and. calculate how much. Clarendon County Sc Property Tax Rate.

From dxoldemjm.blob.core.windows.net

What Is The Property Tax Rate In South Carolina at Ronald Spencer blog Clarendon County Sc Property Tax Rate internet payments will reflect the following business day. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. Payments mailed or delivered to the auditor and treasurer’s office will. Compare your rate to the south carolina and. calculate how much you'll pay in property. Clarendon County Sc Property Tax Rate.

From hxesidoha.blob.core.windows.net

Clarendon County Sc Property Card at Pedro Rasmussen blog Clarendon County Sc Property Tax Rate Payments mailed or delivered to the auditor and treasurer’s office will. internet payments will reflect the following business day. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a. Clarendon County Sc Property Tax Rate.

From www.expansionsolutionsmagazine.com

Clarendon County, SC A Destination for Success Expansion Solutions Clarendon County Sc Property Tax Rate Payments mailed or delivered to the auditor and treasurer’s office will. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. internet payments will reflect the following business day. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on. Clarendon County Sc Property Tax Rate.

From www.southcarolinalanddeals.com

1.20 +/ Acres RAW LAND on Loss Brook Rd Tax Map 143000400400 (Clarendon County) Palmetto Clarendon County Sc Property Tax Rate Compare your rate to the south carolina and. An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. Payments mailed or delivered to the auditor and. Clarendon County Sc Property Tax Rate.

From americanlegaljournal.com

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal Journal Clarendon County Sc Property Tax Rate Payments mailed or delivered to the auditor and treasurer’s office will. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. Compare your rate to the south carolina and. An important role of the clarendon county assessor’s office is to establish fair market value for all. Clarendon County Sc Property Tax Rate.

From www.facebook.com

Clarendon County Administration Manning SC Clarendon County Sc Property Tax Rate the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. internet payments will reflect the following business day. Compare your rate to the south carolina and. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.. Clarendon County Sc Property Tax Rate.

From diaocthongthai.com

Map of Clarendon County, South Carolina Clarendon County Sc Property Tax Rate Compare your rate to the south carolina and. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. An important role of the clarendon county assessor’s office. Clarendon County Sc Property Tax Rate.

From www.landwatch.com

Manning, Clarendon County, SC Lakefront Property, Waterfront Property, House for sale Property Clarendon County Sc Property Tax Rate internet payments will reflect the following business day. Payments mailed or delivered to the auditor and treasurer’s office will. Compare your rate to the south carolina and. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our office’s goal through this website is to provide you with a. Clarendon County Sc Property Tax Rate.

From www.easyknock.com

South Carolina Property Tax Rate Guide EasyKnock Clarendon County Sc Property Tax Rate calculate how much you'll pay in property taxes on your home, given your location and assessed home value. internet payments will reflect the following business day. Compare your rate to the south carolina and. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property.. Clarendon County Sc Property Tax Rate.

From www.icsl.edu.gr

When Are Property Taxes Due 2023 Clarendon County Sc Property Tax Rate internet payments will reflect the following business day. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. Payments mailed or delivered to the auditor and. Clarendon County Sc Property Tax Rate.

From www.landwatch.com

Manning, Clarendon County, SC Lakefront Property, Waterfront Property, House for sale Property Clarendon County Sc Property Tax Rate An important role of the clarendon county assessor’s office is to establish fair market value for all real property in. Compare your rate to the south carolina and. our office’s goal through this website is to provide you with a convenient resource to conduct your business, whether it’s paying your property. calculate how much you'll pay in property. Clarendon County Sc Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Clarendon County Sc Property Tax Rate calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Payments mailed or delivered to the auditor and treasurer’s office will. the median property tax (also known as real estate tax) in clarendon county is $477.00 per year, based on a median home value. An important role of the clarendon. Clarendon County Sc Property Tax Rate.